Experts in M&A

We are committed to quality, integrity, creativity and creating value for our customers

THE DEAL

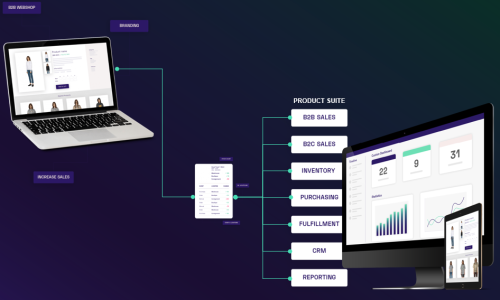

TRAEDE, the Danish-based software company providing cloud ERP solutions to brands, wholesalers and retailers across the Nordics has been acquired by Duett Software Group (DSG), a leading provider of cloud-based accounting, ERP and financial management software solutions.

INSIGHT

Through the partnership with Duett Software Group, TRAEDE will continue its growth journey and keep delivering impactful solutions for fashion brands and product owners. According to Erik Harrell, CEO of Duett Software Group, the acquisition marks DSG’s commitment to the e-commerce and retail verticals, reinforcing its growth strategy in Norway and across the Nordic region. Duett intends to integrate TRAEDE’s powerful tools into DSG’s portfolio, providing a combined offering, which provides existing and future customers with broader, end-to-end solutions that streamline business operations and enhance scalability. “This acquisition is a natural next step in our journey as we build leading positions in verticals across the Nordics that complement our existing product offerings and serve the evolving needs of our customers”, says Erik Harrell. Christopher Heilmann, CEO of TRAEDE, comments: “This marks an exciting new chapter for our company, as we join forces with a leading provider of advanced software solutions. Our shared vision for innovation, customer success, and growth will propel us forward, allowing us to deliver even greater value and cutting-edge solutions to our clients. The TRAEDE team will continue to operate with the same passion, dedication, and commitment to excellence that you’ve come to expect from us. Together with Duett Software Group, we will enhance our capabilities, broaden our offerings, and make an even bigger impact in the industry.”

THE DEAL

The family-owned and largest fish farming group in Denmark, AquaPri, has been acquired by the van der Wees family, which is now the new majority shareholder of the company. The two families share a common ambition to consolidate and expand the over 100-year-old company. AquaPri is the market leader within sustainable production of high-quality trout, trout caviar and fresh zander.

INSIGHT

With the partnership, the van der Wees family becomes the new majority shareholder of AquaPri as of 1st of October. The Priess family will retain a significant shareholding, and Henning and Morten Priess, who have led the company for the past 20 years, will continue in the management team, closely together with the new CEO, Alexandre van der Wees. “My family and I are proud to partner with the Priess family, who, over the past 124 years, have developed a beautiful company that provides high quality products and a great place to work. Moving to Denmark already from 1st of October, I am particularly excited to join the team of experts that make up AquaPri and look forward to continuing to learn about the company through its operations and alongside industry specialists,” states Alexandre van der Wees. For the Priess family, the partnership with the van der Wees family marks the end of a thorough search for the right strategic partner. “We have been looking for a partner to help us develop and grow AquaPri for some time. But we have also allowed ourselves to be picky and take the time needed. We first met Alexandre in 2019, and the ties that we have bound with the van der Wees family through the past 5 years have convinced us that they are the perfect partner. Our families share the same values and have a mutual and long-term ambition to develop AquaPri, which is extremely important to us,” says Henning Priess

THE DEAL

Spangenberg & Madsen (S&M) acquired the business activities of Dansk Energi Management (DEM). The acquirer, Spangenberg & Madsen, offers consulting services in construction, infrastructure, industry, fire safety, security, documentation, electrical systems, plumbing, and HVAC. With the acquisition of DEM, S&M will also offer sustainability consulting, energy efficiency, technical advisory, and international projects in the areas of renewable energy, monitoring & evaluation, and climate & environment.

INSIGHT

The CEO of DEM, Jørn Lykou, will stay on at DEM as Global Business Director, working alongside the new head of the global division, Heidi Kristiansen, to manage the daily operations. Jørn comments: “This transaction marks a new and exciting chapter for both DEM and Spangenberg & Madsen. We will continue to operate under the DEM name, and our commitment to delivering the same high quality and service that our customers and partners expect remains unchanged.”

The Deal

Adelis Equity, the leading and Nordic growth-focused private equity firm, has entered into an agreement to acquire Bruhn NewTech, the world’s leading provider of CBRN knowledge management software. The investment marks Adelis’ first step towards the creation of a leading European technology defence group. Bruhn NewTech exists to increase the number of people protected from airborne threats. With more than 30 years of experience with CBRN software solutions, Bruhn NewTech supplies civil authorities and more than 80% of NATO forces in more than 40 countries worldwide with proven and lifesaving CBRN knowledge management software.

Insight

Through the partnership with Adelis, Bruhn NewTech will continue its growth journey and support more countries and societies in their efforts to protect their citizens. With the support from Adelis, Bruhn NewTech will continue to enhance its software to increase the capabilities of its current and future customers when it comes to CBRN readiness. “We are impressed by Bruhn NewTech’s position within the niche of CBRN related software. Through persistency over the years, Erik and his team have established Bruhn NewTech as the clear global leader in their field of expertise. We are excited to support Bruhn NewTech to further enhance its product and offering to help them protect societies and people across the world”, says Hampus Nestius and Joel Russ at Adelis. CEO Erik Juel Ellinghaus and Chairman Kristoffer Basse, who will both remain shareholders in the company, say: “We are looking forward to the partnership with Adelis. They have an impressive background in supporting software companies to grow globally and we are excited to actively participate in the creation of a strong technology defence group. Furthermore, we are encouraged to see that they share our vision to make the world a safer place and better prepared for CBRN events”.

“We are proud of our long-standing and close customer relationships and enjoy the trust of our clients and partners.”

partner Team

We are committed to quality, integrity, creativity and creating value for our customers

Focus areas

Healthcare

IT & Technology

Financial Services

Complex Business Services

Growth and transition

We always base our advice on market and sector-specific factors that influence valuation and the field of potential investors.