IT & Technology

Nordic M&A’s IT & Technology gruppe

Vi fokuserer på at hjælpe danske og nordiske IT- og teknologibaserede virksomheder med at indgå partnerskaber med de rette investorer, for at kunne realisere deres fulde potentiale

IT og software er komplekst og kræver specialiseret viden. Vores langsigtede fokus på software og vores erfaring fra transaktioner har gjort os i stand til at vurdere og identificere fremtidige vindere i softwaresektoren. Vi har rådgivet i forbindelse med mange M&A transaktioner i softwaresektoren. Vi forstår investeringskriterierne for de førende internationale softwareinvestorer, og vi kender vores lokale marked. Denne kombination bidrager fortsat til vores mange succesfulde transaktioner inden for softwaresektoren.

Vi har et meget stærkt netværk til de førende internationale vækst- og teknologiinvestorer. Vi har gennemført mange transaktioner med dem og vi ved, hvad de er på udkig efter

Vi forstår digitale forretningsmodeller og vi ved, hvilke KPI’s investorerne værdsætter og den værdi, der kan forventes skabt på den baggrund

UDVALGTE TRANSAKTIONER

THE DEAL

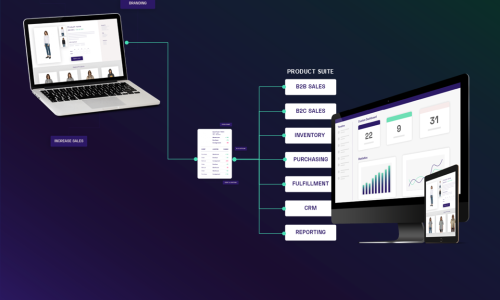

TRAEDE, the Danish-based software company providing cloud ERP solutions to brands, wholesalers and retailers across the Nordics has been acquired by Duett Software Group (DSG), a leading provider of cloud-based accounting, ERP and financial management software solutions.

INSIGHT

Through the partnership with Duett Software Group, TRAEDE will continue its growth journey and keep delivering impactful solutions for fashion brands and product owners. According to Erik Harrell, CEO of Duett Software Group, the acquisition marks DSG’s commitment to the e-commerce and retail verticals, reinforcing its growth strategy in Norway and across the Nordic region. Duett intends to integrate TRAEDE’s powerful tools into DSG’s portfolio, providing a combined offering, which provides existing and future customers with broader, end-to-end solutions that streamline business operations and enhance scalability. “This acquisition is a natural next step in our journey as we build leading positions in verticals across the Nordics that complement our existing product offerings and serve the evolving needs of our customers”, says Erik Harrell. Christopher Heilmann, CEO of TRAEDE, comments: “This marks an exciting new chapter for our company, as we join forces with a leading provider of advanced software solutions. Our shared vision for innovation, customer success, and growth will propel us forward, allowing us to deliver even greater value and cutting-edge solutions to our clients. The TRAEDE team will continue to operate with the same passion, dedication, and commitment to excellence that you’ve come to expect from us. Together with Duett Software Group, we will enhance our capabilities, broaden our offerings, and make an even bigger impact in the industry.”

The Deal

Adelis Equity, the leading and Nordic growth-focused private equity firm, has entered into an agreement to acquire Bruhn NewTech, the world’s leading provider of CBRN knowledge management software. The investment marks Adelis’ first step towards the creation of a leading European technology defence group. Bruhn NewTech exists to increase the number of people protected from airborne threats. With more than 30 years of experience with CBRN software solutions, Bruhn NewTech supplies civil authorities and more than 80% of NATO forces in more than 40 countries worldwide with proven and lifesaving CBRN knowledge management software.

Insight

Through the partnership with Adelis, Bruhn NewTech will continue its growth journey and support more countries and societies in their efforts to protect their citizens. With the support from Adelis, Bruhn NewTech will continue to enhance its software to increase the capabilities of its current and future customers when it comes to CBRN readiness. “We are impressed by Bruhn NewTech’s position within the niche of CBRN related software. Through persistency over the years, Erik and his team have established Bruhn NewTech as the clear global leader in their field of expertise. We are excited to support Bruhn NewTech to further enhance its product and offering to help them protect societies and people across the world”, says Hampus Nestius and Joel Russ at Adelis. CEO Erik Juel Ellinghaus and Chairman Kristoffer Basse, who will both remain shareholders in the company, say: “We are looking forward to the partnership with Adelis. They have an impressive background in supporting software companies to grow globally and we are excited to actively participate in the creation of a strong technology defence group. Furthermore, we are encouraged to see that they share our vision to make the world a safer place and better prepared for CBRN events”.

The Deal

Nordic M&A advised Avenida Consult, a Danish consultancy specializing in providing IT freelance consultants to private companies and public institutions, on the sale to Right People Group, a leading Capidea-backed consulting firm. Avenida’s business model is centered around highly qualified freelance IT consultants with proven track records and skills, offering clients the necessary resources and flexibility to navigate the forefront of IT trends and workforce changes. From its headquarters in Hellerup, Avenida is operated by an efficient team of nine employees along with an extensive network of more than 2,500 freelancers.

Insight

“Avenida has established a strong market position in recent years and achieved impressive results,” says Agner Mark, Chairman of RPG. He adds, “Avenida and Right People Group complement each other perfectly and make an excellent match. We are very much looking forward to collaborating with Jesper Geisler and his talented team.” “At Avenida, we are very familiar with Right People Group and have long been impressed with their well-run business, especially their leading role in digitizing sales and delivery processes and their ability to scale and internationalize their concept. We are all incredibly excited to become part of RPG. The process leading up to the acquisition has further confirmed that we are joining a company with a strong and ambitious leadership team, whose visions we share to a large extent,” says Jesper Geisler, CEO of Avenida.

The Deal

The Danish – based IT provider Danoffice IT has entered into an agreement to acquire Conecto A/S a leading Danish IT company specializing in IT services. Since its inception, Conecto has provided critical IT solutions to both large and small businesses as well as public organizations and institutions. The company is headquartered in Søborg and is one of the five Danish Citrix Platinum partners.

Insight

“To become a part of Danoffice IT will enhance the potential for Conecto,” says Tobias Nawrocki, CEO of Conecto. “By combining our strengths, we expand the strategic opportunities to great value for our customers, granting them access to a provider with an ev en broader range of expertise and capabilities. The Conecto family will benefit from being part of an organization with the same DNA and fantastic growth prospects. We are extremely excited about our new joint venture.” “There are evident synergies betwee n Conecto and Danoffice IT, and together, they will be able to create even stronger opportunities for customers in the market, both in Denmark and abroad,” says David Hald, co – founder and chairman of Conecto. “Danoffice IT is the ideal partner to further a ccelerate Conecto’s strategic journey. I am very enthusiastic about this new partnership on behalf of our company, employees, and customers.”

The Deal

Nordic M&A was the exclusive financial advisor to AccuRanker on the majority sale to VækstPartner Kapital . We ran a competitive process and VækstPartner Kapital stood out as the best partner for Accuranker and the founder Henrik Jørgensen to build a strong foundation for the continued growth ahead.

Insight

AccuRanker is the leading Search Engine Ranking Page (SERP) for SEO professionals. The growth journey of AccuRanker has accelerated in recent years with the addition of several large logos to the customer portfolio and continuous growth in Annual Recurring Revenue (ARR). This was mainly the result of 3 years of development work to build a tr ue enterprise product. With a strong product , the founder Henrik Jørgensen wanted to find a partner to help realize the potential of AccuRanker. VækstPartner Kapital was the solution. VækstPartner Kapital is a private equity fund with a focus on Danish B2B growth companies and a good track record working with B2B SaaS companies. As co – owners, they are extraordinarily active contributors to the execution of strategic initiatives and value creation based on deep operational experience in their team.

The Deal

Nordic M&A advised the Danish content – based corporate E – learning platform GoLearn.dk on the sale to Eduhouse Oy, the Verdane – backed corporate learning tech company, to cement its Nordic champion position. GoLearn.dk is a powerful content – based corporate E – learning platform, offering a wide range of online corporate courses targeted at the Danish business community. The company taps into the rapidly growing EdTech space w ith the ambition to make competence development exciting and easily accessible through value – added content from subject experts and best – in – class production setup.

Insight

“The potential and demand for corporate learning increases rapidly and we are happy to be part of Eduhouse’s growth journey. The management and board of Eduhouse have been focused on finding the perfect M&A match in line with the strategy to solidify the group’s position as a clear Nordic market leader, and with GoLearn we found that and more”, says Iikka Moilanen, Principal at Verdane. “This is a great opportunity for both our customers and our company to join Eduhouse and seek new growth. Our way of working and vision of the future of corporate – learning match well. Together we will offe r Nordic’s best competence development education to tackle the increasing demand of lifelong learning”, says Tue Lindblad, Co – Founder of GoLearn.dk.

The Deal

PLX AI is the world’s fastest real time financial news service powered by artificial intelligence and machine learning. The platform delivers breaking financial news and insight that moves stock prices — including surprise earnings, outlook changes, mergers and acquisitions, important orders or management decisions — from 1,500 companies across the U.S. and Europe, using natural language processing engines. Following the transaction PLX AI is integrated into Reuters News.

Insight

Thomson Reuters acquired PLX A I as part of their commitment to deliver the fastest, most reliable financial news service to clients globally. The acquisition supports Reuters’ financial text reporting and track record in speed wins. In addition, Thomson Reuters can scale or extend PLX AI’s technology into other fields to enhance the newsroom and support journalists.

The deal

Visma has acquired mySupply. The acquisition strengthens Visma’s ownership and position within the digital infrastructure and invoice and document management in the Danish market. MySupply was founded in 2000 and is located in Aabybro near Aalborg. Their client list includes several regional bodies, state agencies, and large private companies.

Insight

With the acquisition of mySupply, Visma adds one of the country’s leading suppliers of solutions for electronic commerce and system integrations to its growing family. Visma brings development processes and digital solutions to the table that complements mySupply’s solid foundation.

The deal

Main Capital Partners (“Main”), Europe’s leading software investor, backed the company in 2019 with the goal for Assessio to become the market leader in Europe for HR-technology and digital recruitment services. After completion of its second add- on acquisition in the Netherlands in October, the Assessio Group (“Assessio”) is now further expanding in the Nordic region with the acquisition of Danish e-assessment company, People Test Systems (“PTS”). “In recent years, we have grown significantly and are today so strong in the market that it is time to become part of something bigger and more international. Our customers will continue to be able to enjoy our high quality and extensive service offering but we can now give them greater access to a broader range of products and additional expertise.” – Torben Tolstøj, CEO and majority shareholder at PTS.

Insight

The addition of PTS further strengthens Assessio’s “zero talent waste” philosophy, which aims to allow organisations to recruit more inclusively through the use of data and modern work psychology. This is an extremely important factor, according to Pär Cederholm, as the Assessio Group aims to change outdated recruitment processes in all of its current geographies.

The Deal

Mindworking was founded on the promise to provide real estate agents with the most powerful marketing system to help them grow their business and value proposition towards the end customer. Since its establishment in 2003, Mindworking has invested heavily in developing a state – of – the – art SaaS platform and is today the category leader in Denmark, with a full SaaS – based real estate agent software platform and with more than 75% of the largest estate agent chains in Denmark as customers. Mindworking has continuously expanded its product offering and the underlying total addressable market by adding new functionality and features. Today Mindworking offers a one – stop product suite to handle all daily agency operations from new customer leads to final sales. The system functions as the backbone of all agencies, handling everything from new leads, customer communication, document handling, websites, property valuation, and the functionality to create all necessary marketing material ready for d istribution on all leading and relevant platforms.

Insight

Reapit, an Estate Agency Business Platform provider, delivers software solutions to 65,000 users in 5,200+ offices and supports in excess of 225,000 tenancies across the UK and Australia. Backed b y Accel – KKR, a global leading technology – focused investment firm with $10 billion in capital commitments, this acquisition comes as part of Reapit’s ambitious global expansion programme and provides Reapit with a firm foothold in Northern Europe.

The Deal

Visma Custom Solutions expands its offering in the Danish market by acquiring IT Minds, a company that specialises in developing young IT talents. IT Minds specialises in recruiting talented IT students and graduates and developing their talents to become some of the best IT consultants in the market. This has earned them the position as one of the most favoured employers among Danish IT students. IT Minds has been part of IT service provider EG’s portfolio for the past seven years.

Insight

IT Mi nds develops IT projects and innovative IT solutions for half of Denmark’s C25 companies, start – ups and the public sector in Denmark. At the same time, it develops IT talents and specialise in recruiting ambitious IT talents at the beginning of their caree rs. Visma offers software and services that simplify and digitalise core business processes in the private and public sectors. The Visma group operates across the entire Nordic region along with Benelux, Central and Eastern Europe. With more than 12,000 em ployees, over 1,000,000 customers and net revenue of €1.7 billion in 2020, Visma is one of Europe’s leading software companies.

The Deal

Cybot has developed the world’s leading consent management platform, Cookiebot , a fully automated, SaaS – based and built around website scanner that detects all cookies and similar website trackers on more than 350,000 websites globally with more than 10 billion user consents under management. Cookiebot is a plug – and – play consent m anagement platform that gives the website owners the ability to easily comply with current privacy regulation such as GDPR, ePR, CCPA, LGPD, etc. The solution automatically scans websites for all cookies and similar trackers and controlling these until the consent has been given by the website user.

Insight

Since the enforcement of GDPR on 25 May 2018, Cybot has grown significantly and reached more than 350,000 websites in more than 90 countries in less than two years, with yearly revenue growth rates abov e 100%. Cybot is located in Denmark, with an employee base of 45 individuals. Full In Partners is a USDm 200 growth equity firm that focuses primarily on software, mobile and online marketplace investments. Full In Partners evaluates companies globally, w ith particular focus on the US, European and Israeli markets and invests in companies with demonstrated product – market fit and rapid growth trajectory. Full In Partners has identified Cybot as a global market leader within consent management platforms with superior technology and are excited to assist them on their further journey to create the truly global leading e – privacy powerhouse.

The Deal

Since Siteimprove was established in 2003 it has been on an international growth journey leading up to a minority share sale to the American Private Equity firm Summit Partners in 2015, where Nordic M&A was exclusive financial advisors to Siteimprove. Today, Siteimprove has 550 employees in 15 countries and over 7,200 customers globally reaching recurring revenues of above USD 81.6 million (2019 figures). Siteimprove has significant long – term growth potential, driven by increasing market penetration, expansion in key customer segments, and opportunity – generating past investments in product development and platform solutions. Nordic Capital will support Siteimprove’s further development and international expansion by investing in the organi sation and product offering, accelerating its growth as a strong and sustainable company. Morten Ebbesen will continue as significant minority shareholder in the Company and remain as CEO. Growth equity investor Summit Partners, the company’s current min ority shareholder, will divest its holding upon completion of the transaction.

The Deal

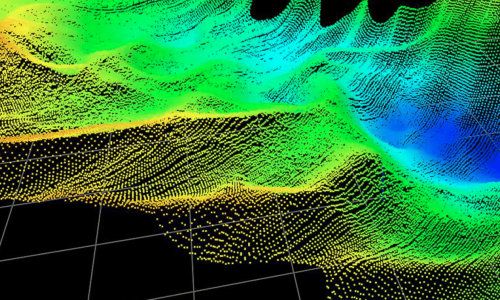

Nordic M&A was the exclusive financial advisor to Infare Solutions (Infare) on the acquisition of QL2 Software’s (QL2) air data business backed by Ventiga Capital Partners (Ventiga). The acquisition of QL2 supported Infare’s goal to enhance its offer in airfare data and analysis tools focused entirely on serving the needs of airlines and airports.

Insight

The airfare intelligence specialist Infare was founded in 2000 in Copenhagen, and today more than 165 airlines and airports rely on Infare to deliver high- quality, consistent airfare data and analysis tools that enable day-to-day and long-term strategic revenue management. Infare employs 80 specialists and delivers more than 2.5 billion airfare observations to its customers worldwide every day through customised data files. The acquisition was fully in line with Infare’s strategy of delivering the most comprehensive data and competitive intelligence tools for the global airline industry. Ventiga – a leading London-based private equity fund – is now a shareholder in Infare and backs Infare and its management team in its growth strategy. Ventiga funded the QL2 deal through an investment in Infare. As a result of the transaction, Infare took over QL2’s current airline and airport customers consolidating the position as the clear global.

The Deal

Nordic M&A was the exclusive financial advisor to Siteimprove on the investment from Summit Partners. The investment supported Siteimprove’s continued expansion of its global operations, sales and marketing as well as the development of its software distribution solutions for web governance (SaaS / cloud).

Insight

Siteimprove A/S was founded in Copenhagen in 2003 and is a leading provider of web governance software. Siteimprove’s headquarters are situated in Copenhagen and Minneapolis, and the company has 500 employees across eleven global offices. More than 3,500 customers rely on Siteimprove to enhance their web and mobile sites and ensure adherence with external regulations and internal content policies. Siteimprove is the global leader in SaaS-based web governance solutions, and its SaaS platform enables marketers and web professionals to manage and optimise their web presence through automated quality assurance, accessibility compliance and analytics. In 2015 Siteimprove had experienced twelve years of strong organic growth, profitability and global expansion, and therefore the company was looking for an experienced global partner who could support Siteimprove as it continued to scale internationally. Summit Partners is a leading global growth equity firm established in 1984 with a commitment to partner with exceptional entrepreneurs to help them accelerate their growth and achieve dramatic results. The investment has made it possible for Siteimprove to accelerate growth and capitalise on opportunities in the broader web governance market.