Referencer

THE DEAL

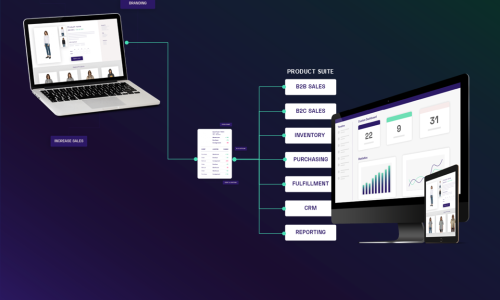

TRAEDE, the Danish-based software company providing cloud ERP solutions to brands, wholesalers and retailers across the Nordics has been acquired by Duett Software Group (DSG), a leading provider of cloud-based accounting, ERP and financial management software solutions.

INSIGHT

Through the partnership with Duett Software Group, TRAEDE will continue its growth journey and keep delivering impactful solutions for fashion brands and product owners. According to Erik Harrell, CEO of Duett Software Group, the acquisition marks DSG’s commitment to the e-commerce and retail verticals, reinforcing its growth strategy in Norway and across the Nordic region. Duett intends to integrate TRAEDE’s powerful tools into DSG’s portfolio, providing a combined offering, which provides existing and future customers with broader, end-to-end solutions that streamline business operations and enhance scalability. “This acquisition is a natural next step in our journey as we build leading positions in verticals across the Nordics that complement our existing product offerings and serve the evolving needs of our customers”, says Erik Harrell. Christopher Heilmann, CEO of TRAEDE, comments: “This marks an exciting new chapter for our company, as we join forces with a leading provider of advanced software solutions. Our shared vision for innovation, customer success, and growth will propel us forward, allowing us to deliver even greater value and cutting-edge solutions to our clients. The TRAEDE team will continue to operate with the same passion, dedication, and commitment to excellence that you’ve come to expect from us. Together with Duett Software Group, we will enhance our capabilities, broaden our offerings, and make an even bigger impact in the industry.”

THE DEAL

The family-owned and largest fish farming group in Denmark, AquaPri, has been acquired by the van der Wees family, which is now the new majority shareholder of the company. The two families share a common ambition to consolidate and expand the over 100-year-old company. AquaPri is the market leader within sustainable production of high-quality trout, trout caviar and fresh zander.

INSIGHT

With the partnership, the van der Wees family becomes the new majority shareholder of AquaPri as of 1st of October. The Priess family will retain a significant shareholding, and Henning and Morten Priess, who have led the company for the past 20 years, will continue in the management team, closely together with the new CEO, Alexandre van der Wees. “My family and I are proud to partner with the Priess family, who, over the past 124 years, have developed a beautiful company that provides high quality products and a great place to work. Moving to Denmark already from 1st of October, I am particularly excited to join the team of experts that make up AquaPri and look forward to continuing to learn about the company through its operations and alongside industry specialists,” states Alexandre van der Wees. For the Priess family, the partnership with the van der Wees family marks the end of a thorough search for the right strategic partner. “We have been looking for a partner to help us develop and grow AquaPri for some time. But we have also allowed ourselves to be picky and take the time needed. We first met Alexandre in 2019, and the ties that we have bound with the van der Wees family through the past 5 years have convinced us that they are the perfect partner. Our families share the same values and have a mutual and long-term ambition to develop AquaPri, which is extremely important to us,” says Henning Priess

THE DEAL

Spangenberg & Madsen (S&M) acquired the business activities of Dansk Energi Management (DEM). The acquirer, Spangenberg & Madsen, offers consulting services in construction, infrastructure, industry, fire safety, security, documentation, electrical systems, plumbing, and HVAC. With the acquisition of DEM, S&M will also offer sustainability consulting, energy efficiency, technical advisory, and international projects in the areas of renewable energy, monitoring & evaluation, and climate & environment.

INSIGHT

The CEO of DEM, Jørn Lykou, will stay on at DEM as Global Business Director, working alongside the new head of the global division, Heidi Kristiansen, to manage the daily operations. Jørn comments: “This transaction marks a new and exciting chapter for both DEM and Spangenberg & Madsen. We will continue to operate under the DEM name, and our commitment to delivering the same high quality and service that our customers and partners expect remains unchanged.”

The Deal

Adelis Equity, the leading and Nordic growth-focused private equity firm, has entered into an agreement to acquire Bruhn NewTech, the world’s leading provider of CBRN knowledge management software. The investment marks Adelis’ first step towards the creation of a leading European technology defence group. Bruhn NewTech exists to increase the number of people protected from airborne threats. With more than 30 years of experience with CBRN software solutions, Bruhn NewTech supplies civil authorities and more than 80% of NATO forces in more than 40 countries worldwide with proven and lifesaving CBRN knowledge management software.

Insight

Through the partnership with Adelis, Bruhn NewTech will continue its growth journey and support more countries and societies in their efforts to protect their citizens. With the support from Adelis, Bruhn NewTech will continue to enhance its software to increase the capabilities of its current and future customers when it comes to CBRN readiness. “We are impressed by Bruhn NewTech’s position within the niche of CBRN related software. Through persistency over the years, Erik and his team have established Bruhn NewTech as the clear global leader in their field of expertise. We are excited to support Bruhn NewTech to further enhance its product and offering to help them protect societies and people across the world”, says Hampus Nestius and Joel Russ at Adelis. CEO Erik Juel Ellinghaus and Chairman Kristoffer Basse, who will both remain shareholders in the company, say: “We are looking forward to the partnership with Adelis. They have an impressive background in supporting software companies to grow globally and we are excited to actively participate in the creation of a strong technology defence group. Furthermore, we are encouraged to see that they share our vision to make the world a safer place and better prepared for CBRN events”.

The Deal

Doral Energy, the global leader in renewable energy, has secured a financing deal with a Danish bank for up to DKK 225m of the DKK 330m Urup solar facility in Denmark, after running a competitive process with several Danish and international financing partners. The Urup solar facility has a capacity of 60 MWp and will produce 75.5 GWh of green electricity annually, enough to power more than 18,800 Danish homes. It will also eliminate about 8,800 tons of CO2 emissions every year from the Danish energy production. The solar park will be connected to the grid by the end of 2024.

Insight

The Doral Group is a leading company in renewable energy, operating in Israel and around the world since 2007. In addition to its large portfolio of profitable PV and storage projects, Doral is developing the first green hydrogen production facility in Israel and is a pioneer and leader in investing in clean-tech through its investment arm Doral Energy-Tech Ventures. The company supplies electricity to major businesses and is the largest and leading provider of green electricity in Israel. Yaki Noyman, CEO of Doral Energy comments on the perspectives: “We are excited to see our first solar park in Denmark, out of many to come, being constructed. This project is especially exciting due to the capacity and the possibility to apply the latest in solar PV technology to maximise yield. We appreciate our strong partnership with GreenGo Energy, the local landowners, and other stakeholders on this project.”

The Deal

Nordic M&A advised Avenida Consult, a Danish consultancy specializing in providing IT freelance consultants to private companies and public institutions, on the sale to Right People Group, a leading Capidea-backed consulting firm. Avenida’s business model is centered around highly qualified freelance IT consultants with proven track records and skills, offering clients the necessary resources and flexibility to navigate the forefront of IT trends and workforce changes. From its headquarters in Hellerup, Avenida is operated by an efficient team of nine employees along with an extensive network of more than 2,500 freelancers.

Insight

“Avenida has established a strong market position in recent years and achieved impressive results,” says Agner Mark, Chairman of RPG. He adds, “Avenida and Right People Group complement each other perfectly and make an excellent match. We are very much looking forward to collaborating with Jesper Geisler and his talented team.” “At Avenida, we are very familiar with Right People Group and have long been impressed with their well-run business, especially their leading role in digitizing sales and delivery processes and their ability to scale and internationalize their concept. We are all incredibly excited to become part of RPG. The process leading up to the acquisition has further confirmed that we are joining a company with a strong and ambitious leadership team, whose visions we share to a large extent,” says Jesper Geisler, CEO of Avenida.

The Deal

Multitude, a listed European FinTech company, has agreed to acquire Omniveta, through their business unit, CapitalBox. Omniveta is an invoice purchasing company founded in 2012 dedicated to improving lending liquidity for SMEs across Denmark. With this acquisition, CapitalBox is further expanding its market position in the area of business loans, reinforcing Multitude’s SME banking segment.

Insight

Omniveta will assume the name CapitalBox moving forward, and the team will be integrated into CapitalBox’s Danish division. This acquisition will add invoice purchasing to CapitalBox’s offering for SMEs in Denmark and an opportunity to extend the product across all the markets that CapitalBox currently serves. “We are delighted that Omniveta will be part of Multitude going forward. With the acquisition of Omniveta, we are not only strengthening CapitalBox’s position in the European market, we are also reaffirming our ambition to become the leading provider of non-bank loans in Europe,” says Jorma Jokela, CEO of Multitude. “Omniveta is the perfect add-on to our existing product offering. By combining CapitalBox and Omniveta, we are consistently expanding our business model and our added value. We will be able to make Omniveta’s expertise available not only in the Danish market, but to all our customers across Europe,” says Lasse Mäkelä, Chief Strategy and IR Officer of Multitude.

The Deal

The largest player on Denmark’s automotive market in Denmark and a reliable agriculture partner, Semler Gruppen, has entered into an agreement to acquire H.P. Entreprenørmaskiner, a leading construction machinery solutions provider in Denmark, Greenland and the Faroe Islands. Since its inception in 1981, H.P. Entreprenørmaskiner has become a leading importer of construction machinery and equipment from the world’s top manufacturers, including Hitachi Construction Machinery. The company is headquartered in Bjæverskov just southwest of the Capital Region of Denmark.

Insight

According to Semler Gruppen’s CEO, Ulrik Drejsig, the ambition is to strengthen and diversify the company’s portfolio and enter the attractive market for the sale of construction machinery: “H.P. Entreprenørmaskiner is a strong and well-run business with deep expertise in construction machinery. The acquisition provides us with an optimal foundation to establish ourselves in the industry and, through our skills and size, deliver even better service to our customers,” says Ulrik Drejsig. Hans Peter Pedersen, CEO and founder of H.P. Entreprenørmaskiner says: “It holds significance who carries forward one’s business after over 40 years, and the Semler Group is unquestionably the ideal candidate to elevate the business to the next level. Entrusting the company to them ensures future resilience, grounded in shared values and a vision for developing the business.”

The Deal

The leading Danish asset manager Artha is merging with Scope Investment, creating a combined asset management company with a total of DKK 24 billion in AUM

Insight

Artha has DKK 18 billion in AUM, while Scope Investment has over DKK 6 billion under management. Thus, the total group will have approximately DKK 24 billion in AUM. The new group is intended to operate as a Multi-Family Office. The daily management will be comprised of Jan Severin Sølbæk and Brian Kudsk, both of whom are managing directors and partners at Artha. Jonas Melchior, who founded Scope Investment in 2016, joins as an equal member of the executive board

The Deal

The Danish – based IT provider Danoffice IT has entered into an agreement to acquire Conecto A/S a leading Danish IT company specializing in IT services. Since its inception, Conecto has provided critical IT solutions to both large and small businesses as well as public organizations and institutions. The company is headquartered in Søborg and is one of the five Danish Citrix Platinum partners.

Insight

“To become a part of Danoffice IT will enhance the potential for Conecto,” says Tobias Nawrocki, CEO of Conecto. “By combining our strengths, we expand the strategic opportunities to great value for our customers, granting them access to a provider with an ev en broader range of expertise and capabilities. The Conecto family will benefit from being part of an organization with the same DNA and fantastic growth prospects. We are extremely excited about our new joint venture.” “There are evident synergies betwee n Conecto and Danoffice IT, and together, they will be able to create even stronger opportunities for customers in the market, both in Denmark and abroad,” says David Hald, co – founder and chairman of Conecto. “Danoffice IT is the ideal partner to further a ccelerate Conecto’s strategic journey. I am very enthusiastic about this new partnership on behalf of our company, employees, and customers.”

The Deal

Amayse is the leading global supplier of 3D advertising for televised sports events and stadium branding solutions . They are the originator of 3D signage and the world’s largest provider of 3D CamCarpets and 3D painted signs at sports events across the glob e

Insight

Amayse is headquartered in Denmark with offices in London and South Africa. Their impressive customer portfolio consists of FC Barcelona, Bayern Munich, UEFA, Chelsea among others.

The Deal

Nordic M&A was the exclusive financial advisor to AccuRanker on the majority sale to VækstPartner Kapital . We ran a competitive process and VækstPartner Kapital stood out as the best partner for Accuranker and the founder Henrik Jørgensen to build a strong foundation for the continued growth ahead.

Insight

AccuRanker is the leading Search Engine Ranking Page (SERP) for SEO professionals. The growth journey of AccuRanker has accelerated in recent years with the addition of several large logos to the customer portfolio and continuous growth in Annual Recurring Revenue (ARR). This was mainly the result of 3 years of development work to build a tr ue enterprise product. With a strong product , the founder Henrik Jørgensen wanted to find a partner to help realize the potential of AccuRanker. VækstPartner Kapital was the solution. VækstPartner Kapital is a private equity fund with a focus on Danish B2B growth companies and a good track record working with B2B SaaS companies. As co – owners, they are extraordinarily active contributors to the execution of strategic initiatives and value creation based on deep operational experience in their team.

The Deal

Nordic M&A advised the Danish content – based corporate E – learning platform GoLearn.dk on the sale to Eduhouse Oy, the Verdane – backed corporate learning tech company, to cement its Nordic champion position. GoLearn.dk is a powerful content – based corporate E – learning platform, offering a wide range of online corporate courses targeted at the Danish business community. The company taps into the rapidly growing EdTech space w ith the ambition to make competence development exciting and easily accessible through value – added content from subject experts and best – in – class production setup.

Insight

“The potential and demand for corporate learning increases rapidly and we are happy to be part of Eduhouse’s growth journey. The management and board of Eduhouse have been focused on finding the perfect M&A match in line with the strategy to solidify the group’s position as a clear Nordic market leader, and with GoLearn we found that and more”, says Iikka Moilanen, Principal at Verdane. “This is a great opportunity for both our customers and our company to join Eduhouse and seek new growth. Our way of working and vision of the future of corporate – learning match well. Together we will offe r Nordic’s best competence development education to tackle the increasing demand of lifelong learning”, says Tue Lindblad, Co – Founder of GoLearn.dk.

The Deal

Royal Unibrew A/S, a multinational beverage company has acquired Nørrebro Bryghus, a leading Danish microbrewery located in Copenhagen. Nørrebro Bryghus is a leading Danish microbrewery located in Copenhagen, Denmark. Founded in 2003, it is one of the pioneers of the Danish craft beer movement. The brewery is known for its innovative and unique beer styles, high quality, sustainable brewing methods and lo cally sourced ingredients.

Insight

Nørrebro Bryghus offers a wide range of beers, including IPAs, stouts, pilsners, and sours. Nørrebro Bryghus distributes its certified organic beers to restaurants and stores from its brewery in Hedehusene and direct – to – consumer through its webshop, the Nørrebro Bryghus brewpub and the Reffen container brewery. Royal Unibrew is a multi – beverage company with local brand portfolios in the Nordic region, the Baltic countries, Italy, and France. Royal Unibrew has a broad po rtfolio within a wide range of categories, including beer, malt beverages, soft drinks, energy drinks, cider/RTD, juice, water, wine, and spirits. In addition to own brands, Royal Unibrew offers license – based international brands from PepsiCo and Heineken in Northern Europe. Royal Unibrew realised net revenue of DKK 8.7 billion and EBIT of 1.7 billion in 2021 .

The Deal

PLX AI is the world’s fastest real time financial news service powered by artificial intelligence and machine learning. The platform delivers breaking financial news and insight that moves stock prices — including surprise earnings, outlook changes, mergers and acquisitions, important orders or management decisions — from 1,500 companies across the U.S. and Europe, using natural language processing engines. Following the transaction PLX AI is integrated into Reuters News.

Insight

Thomson Reuters acquired PLX A I as part of their commitment to deliver the fastest, most reliable financial news service to clients globally. The acquisition supports Reuters’ financial text reporting and track record in speed wins. In addition, Thomson Reuters can scale or extend PLX AI’s technology into other fields to enhance the newsroom and support journalists.

The Deal

RiskPoint Group is a global independent specialty insurance Managing General Underwriter (“MGU”) based in Copenhagen with offices in Stockholm, Oslo, Helsinki, Amsterdam, Frankfurt, Zurich, Madrid, London and New York. The Group offers a wide range of traditional a nd niche insurance solutions within the areas of Mergers & Acquisitions, Renewable Energy, Liabilities including Financial Lines and Cyber, Off – Shore Upstream, Property & Construction and Accident & Health . As one of the leading and most experienced Financ ial Services investors with deep understanding of the sector and an ability to accelerate organic and acquisitive growth, Nordic Capital will support RiskPoint’s continued growth journey in close partnership with the management team.

Insight

RiskPoint gr oup was founded in 2007 and has since then enjoyed successful and profitable growth in Europe and the U.S., focusing on providing leading underwriting, claims and operational capabilities. RiskPoint Group has built a unique global team of over 150 employee s with a strong commercial mindset and best in class service. The ability to enable the execution of strategic long – term goals while retaining the Group’s independence and partnership – controlled business model, was paramount to RiskPoint when finding the r ight investor. Likewise, the alignment of values and culture between RiskPoint and Nordic Capital were key drivers in the decision – making process.

The Deal

Dansk Tandforsikring insurance group, founded in 2010, is the leading dental insurer in Denmark with presence across Scandinavia. The transaction comprises insurance and service provider Dansk Tandforsikring Administration ApS (MGA) and the fully licenced insurance company Gl obal Dental Insurance A/S.

Insight

Gjensidige Forsikring ASA is a Norwegian insurance company listed on the Oslo Stock Exchange with 3,800 employees and operating income of NOK 30 billion in 2021.

The Deal

Further Underwriting International (“Further”) is a leading digitally enabled global niche healthcare insurance and services solutions provider. Founded in 2012 and headquartered in Madrid, Further has successfully established itself as a leading, high gro wth company in its specialty area, with business in over 30 countries through partnerships with more than 300 insurers and employer groups.

Insight

AnaCap Financial Partners is a leading specialist mid – market private equity investor in technology enabled financial services and based in London.

The deal

Kyu has acquired shares in Gehl Architects Holding ApS, an urban strategy and design consulting firm headquartered in Copenhagen, Denmark. Kyu is a strategic operating unit of Hakuhodo DY Holdings Inc. Gehl is an urban strategy and research consultancy offering expertise in the fields of architecture, urban design, landscape architecture, and urban planning. It provides consultation from overall urban planning strategy building to the construction process in general.

Insight

Gehl’s people-centered design philosophy and passion for sustainable urban development are closely aligned with kyu’s purpose—to be a source of creativity which propels the economy and society forward—and the company has already worked with kyu companies such as ATÖLYE, IDEO and SYPartners. Gehl joining the Group enhances not only of kyu’s, but the entire Hakuhodo DY Group’s ability to provide value.

The deal

Visma has acquired mySupply. The acquisition strengthens Visma’s ownership and position within the digital infrastructure and invoice and document management in the Danish market. MySupply was founded in 2000 and is located in Aabybro near Aalborg. Their client list includes several regional bodies, state agencies, and large private companies.

Insight

With the acquisition of mySupply, Visma adds one of the country’s leading suppliers of solutions for electronic commerce and system integrations to its growing family. Visma brings development processes and digital solutions to the table that complements mySupply’s solid foundation.

The deal

ARAS Security is a Danish security solutions company and system developer, specializing in combined alarm and access control systems, smart buildings, and digitization. The company’s solutions are based on the open and modular security system NOX, for which ARAS Security has exclusivity in the Nordics. With main operations in Denmark, ARAS Security has established a local leadership position and are gaining strong traction in Sweden. The acquisition of ARAS Security strengthens Lagercrantz’ leadership position within the security sector as a strong addition to its TecSec division.

Insight

The successful journey of ARAS Security is based on its modern approach to corporate security solutions. With the NOX security system as a base, ARAS can combine the latest technology, which gives customers free choice of card readers, biometrics readers, detectors, and the opportunity for customized applications. Through innovative integrations with the customer’s other operations, ARAS Security provides efficient security solutions tailored to each customer’s unique needs. The partnership with Lagercrantz provides a strong foundation for the future development of ARAS Security and its Nordic expansion plan.

The deal

Main Capital Partners (“Main”), Europe’s leading software investor, backed the company in 2019 with the goal for Assessio to become the market leader in Europe for HR-technology and digital recruitment services. After completion of its second add- on acquisition in the Netherlands in October, the Assessio Group (“Assessio”) is now further expanding in the Nordic region with the acquisition of Danish e-assessment company, People Test Systems (“PTS”). “In recent years, we have grown significantly and are today so strong in the market that it is time to become part of something bigger and more international. Our customers will continue to be able to enjoy our high quality and extensive service offering but we can now give them greater access to a broader range of products and additional expertise.” – Torben Tolstøj, CEO and majority shareholder at PTS.

Insight

The addition of PTS further strengthens Assessio’s “zero talent waste” philosophy, which aims to allow organisations to recruit more inclusively through the use of data and modern work psychology. This is an extremely important factor, according to Pär Cederholm, as the Assessio Group aims to change outdated recruitment processes in all of its current geographies.

The Deal

Daniamant specializes in products that contribute to safety at sea. The company operates with sales on a global market from two production sites in Denmark and UK respectively. Their product range consists of three product groups: Survivor Locator Lights, Bridge and Voyage Alarms, Salinity and Oil – in – Water Sensors. The acquisition of Daniamant strengthens Ernströmgruppen’s portfolio of martime safety companies.

Insight

As a long – standing global market leader within survivor location lights, Daniamant is well – posit ioned to capture additional value with the support from Ernströmgruppen through further penetration of the maritime safety market based on innovative and top – quality products. The new partnership with a larger player will drive additional growth through the capitalization of Danimant’s strong company platform and valuable relations with global segment – leading customers . The acquisition will further strengthen Ernströmgruppen’s position in the marine safety market and provide a solid base for further expansion within the space.

The Deal

Fischer Medical is a Danish company specialized in advanced surgery representing well – recognized suppliers from all over the world. The company has a leading market position in Denmark regarding medical instruments and implants for elective orthopedic surgery and non – invasive gynecology with long – lasting customer relationships to all leading hospitals and clinics.

Insight

AddLife is an independent and public listed European player in Life Science that offers high – quality products, services and consulting to both the private and public sectors. AddLife has about 1,800 employees in around 70 operating subsidiaries, which operate under their own brands with approximately SEK 7 billion in annual sales . With the acquisition of Fischer Medical , Addlife strengthens their presence within advanced surgery in the Nordics and opens up opportunities for co – operation with our other companies in Europe active in the same market segment. Since the beginning of the Covid – 19 pandemic, elective surgeries hav e been postponed which has created large backlogs in many countries. The refocusing within the Health care sector from covid – related treatments to elective surgery is indicating an increased demand for the offering from Fischer Medical in the years to come .

The Deal

Alm. Brand has today entered into a conditional agreement with Nordic I&P to sell Alm. Brand Liv og Pension at a price of DKK 1,100 million. With the acquisition of Alm. Brand Liv og Pension, Nordic I&P going forward will be able to also offer pension schemes to new customers. In connection with the transaction, Alm. Brand Forsikring has entered into a distribution agreement with Nordic I&P on the sale of pension schemes. Alm. Brand Liv og Pension is one of the market’s most well – run life insurance and pension companies with stable, high earnings and return on equity. Alm. Brand Liv og Pension had total pension assets of DKK 16.9 billion at 31 December 2020 and reported a pre – tax prof it of DKK 135 million.

Insight

The owners of Nordic I&P are also in the process of acquiring Norli Pension Livsforsikring A/S, a Danish pension company specialising in handling traditional, average – rate pension agreements. To date, Norli Pension Livsforsik ring A/S has not sold new pension schemes. Based on Alm. Brand Liv og Pension’s market position and experience in selling average – rate pension products, the buyer will in future pursue a strategy which, in addition to consolidating portfolios, will also co ver new sales of the traditional pension product. At 31 December 2020, Norli Pension Livsforsikring A/S had total pension assets of DKK 4.5 billion, and the company reported a pre – tax profit of DKK 22 million for 2020.

The Deal

Mindworking was founded on the promise to provide real estate agents with the most powerful marketing system to help them grow their business and value proposition towards the end customer. Since its establishment in 2003, Mindworking has invested heavily in developing a state – of – the – art SaaS platform and is today the category leader in Denmark, with a full SaaS – based real estate agent software platform and with more than 75% of the largest estate agent chains in Denmark as customers. Mindworking has continuously expanded its product offering and the underlying total addressable market by adding new functionality and features. Today Mindworking offers a one – stop product suite to handle all daily agency operations from new customer leads to final sales. The system functions as the backbone of all agencies, handling everything from new leads, customer communication, document handling, websites, property valuation, and the functionality to create all necessary marketing material ready for d istribution on all leading and relevant platforms.

Insight

Reapit, an Estate Agency Business Platform provider, delivers software solutions to 65,000 users in 5,200+ offices and supports in excess of 225,000 tenancies across the UK and Australia. Backed b y Accel – KKR, a global leading technology – focused investment firm with $10 billion in capital commitments, this acquisition comes as part of Reapit’s ambitious global expansion programme and provides Reapit with a firm foothold in Northern Europe.

The Deal

EAST is an industry leader in providing fashion houses with various garment sourcing and design services with c 190 employees located in Denmark, Germany, Spain and China. EAST has initiated a European expansion plan and aims to accelerate new market entries supported by Accent Equity, a Swedish private equity firm that focuses on investing in Nordic companies where a new partner can serve as a catalyst.

Insight

EAST’s recent success and significant market share gain is based on the combination of Danish – inspired design and local operations in China with a strong network of local suppliers. Through long – standing relations with large prominent fashion houses, EAST consistently provides fast – paced and high – quality sourcing, design and logistics se rvices to the group’s customers across Europe. Key customers include Bestseller, El Corte Ingles, s.Oliver, Bon Prix, IB Company and About You. EAST was previously owned by the management group, key employees and external investors, including CEO and co – founder Poul Skovgaard. Current active owners and the management team will reinvest and continue to develop the group in close cooperation with Accent Equity. The partnership with Accent Equity will strengthen EAST in its recently initiated European expa nsion plan and will also accelerate new market entries as part of the group’s further growth journey.

The Deal

PJM is a leading developer, designer and manufacturer of advanced industrial automation solutions with more than 100 employees and attractive global customers within medico and industrial manufacturing. The acquisition of PJM strengthens BILA’s Scandinavian leadership within industrial automation and robotics and provides a strong platform for further growth through improved competitiveness on the international scene.

Insight

The successful development of PJM is based on its profound knowledge a nd extensive experience in the field of automation processes, enabling PJM to deliver innovative, co – developed machine platform solutions as a preferred partner to a highly attractive portfolio of loyal customers. Key customers include Lego, Novo Nordisk, Coloplast , Convatec, Danfoss and Grundfos. The previous owner, Poul Johansen Foundation, which will retain a minority stake in PJM, welcomes BILA as a great match to further strengthen business activities while ensuring that the founder Poul Johansen’s he ritage endures. The partnership with BILA provides strategic strength to excel in the growing industrial automation market and to accommodate current trends among new and future customers that are setting their sights on rapid transitions and increasingl y streamlined production processes.

The Deal

Ejendomsvirke is a nationwide Danish property management company , servicing more than 350 properties through offering core competencies within property management and various value – adding services within property administration and property maintenance. As part of a broader consolidation in the Nordics, PHM Group expands into Denmark with the acquisition of Ejend omsvirke as a first step towards continued growth in the Danish market.

Insight

Through a customer – driven approach with relentless focus on quality, Ejendomsvirke has created a well – known brand name through a long history in the Danish property management market. T hrough support from Nordic property maintenance specialist PHM Group , Ejendomsvirke is ready to accelerate growth by capitalizing on the leading position in Denmark and strong company platform, including its highly experienced management team, unique employee dedication and up – to – date digital solutions. PHM Group has around 3,000 property maintenance professionals and operations in 30 cities in Finland, 10 cities in Sweden and two cities in Norway.

The Deal

Visma Custom Solutions expands its offering in the Danish market by acquiring IT Minds, a company that specialises in developing young IT talents. IT Minds specialises in recruiting talented IT students and graduates and developing their talents to become some of the best IT consultants in the market. This has earned them the position as one of the most favoured employers among Danish IT students. IT Minds has been part of IT service provider EG’s portfolio for the past seven years.

Insight

IT Mi nds develops IT projects and innovative IT solutions for half of Denmark’s C25 companies, start – ups and the public sector in Denmark. At the same time, it develops IT talents and specialise in recruiting ambitious IT talents at the beginning of their caree rs. Visma offers software and services that simplify and digitalise core business processes in the private and public sectors. The Visma group operates across the entire Nordic region along with Benelux, Central and Eastern Europe. With more than 12,000 em ployees, over 1,000,000 customers and net revenue of €1.7 billion in 2020, Visma is one of Europe’s leading software companies.

The Deal

Nordic Bioscience has established a position as the world’s most experienced company within the extracellular matrix (ECM) through more than 25 years of dedicated research and development. The ECM is the non – cellular component of all tissues and organs and can be analyzed to identify new drug candidates in more than 50 disease areas, diagnose patients and evaluate the effect of existing drugs and drug candidates. Nordic Bioscience owns more than 150 patents and has published over 500 scientific papers in le ading scientific journals. The company has entered into partnerships with the world’s largest pharma companies to develop new drugs in four major disease areas (fibrosis, oncology, diabetes and cardiovascular) and has collaborations with leading diagnostic companies for the use of Nordic Bioscience’s biomarkers for diagnostic purposes. In addition, Nordic Bioscience services a growing international customer base of pharma, biotech and CROs with preclinical and clinical data analysis from its certified labor atory.

Insight

KKR is a leading global investment firm deeply committed to responsible investment, with a dedicated focus on health care growth and on partnering with leading companies and management teams to build and grow great businesses.

The Deal

Cybot has developed the world’s leading consent management platform, Cookiebot , a fully automated, SaaS – based and built around website scanner that detects all cookies and similar website trackers on more than 350,000 websites globally with more than 10 billion user consents under management. Cookiebot is a plug – and – play consent m anagement platform that gives the website owners the ability to easily comply with current privacy regulation such as GDPR, ePR, CCPA, LGPD, etc. The solution automatically scans websites for all cookies and similar trackers and controlling these until the consent has been given by the website user.

Insight

Since the enforcement of GDPR on 25 May 2018, Cybot has grown significantly and reached more than 350,000 websites in more than 90 countries in less than two years, with yearly revenue growth rates abov e 100%. Cybot is located in Denmark, with an employee base of 45 individuals. Full In Partners is a USDm 200 growth equity firm that focuses primarily on software, mobile and online marketplace investments. Full In Partners evaluates companies globally, w ith particular focus on the US, European and Israeli markets and invests in companies with demonstrated product – market fit and rapid growth trajectory. Full In Partners has identified Cybot as a global market leader within consent management platforms with superior technology and are excited to assist them on their further journey to create the truly global leading e – privacy powerhouse.

The Deal

Sanos is a global Contract Research Organization (“CRO”) specialized in osteoarthritis. Sanos is full – service CRO providing value – added services to pharma, biotech and research organizations to help plan and conduct clinical trials, a critical part in the development of new drugs and treatments. Sanos Group consists of a CRO specialized in osteoar thritis (“OA”) and a Site Management Organization (“SMO”) with a broader indication range focusing on lifestyle and age – related diseases. Sanos has built a worldwide reputation for its scientific expertise in osteoarthritis, its ability to recruit patients efficiently and a track record of executing safe and efficient clinical trials. The Sanos Group management will remain shareholders by investing alongside Investcorp.

Insight

In addition to the world – leading CRO business, Sanos Group consists of four sta te – of – the – art clinical research sites, including a brand – new phase I unit opened in Q4 2020. The Group is headquartered in Herlev (Copenhagen) with additional clinics located in Gandrup and Vejle, Denmark. In 2020 the company had a net turnover of DKK 149 m with an EBITDA of DKK 61 m. Investcorp has an established history of investing in the healthcare sector globally. The acquisition of Sanos is Investcorp’s 11th investment in the healthcare sector and its third in Europe.

The Deal

EnviDan is a leading company within consultancy and solutions to the water and wastewater sector, with a strong position and unique competences within the water cycle – also in a European perspective. EnviDan has created high growth and revenue, and the company has, with its more than 260 specialised employees in Denmark, Norway and Sweden, established a strong Nordic platform and a solid basis for further growth. The EnviDan management group will remain shar eholders by investing alongside Waterland Private Equity.

Insight

EnviDan delivers holistic solutions within water, wastewater, energy and environment, as well as financial consultancy combined with a broad suite of software solutions for the Danish, Norw egian and Swedish utilities sectors. EnviDan has offices in Silkeborg (HQ), Aarhus, Aalborg, Kastrup, Lyngby, Oslo, Åndalsnes, Gothenburg, Helsingborg and Malmö. In 2019/20 the company had a net turnover of DKK 271 m with an EBITDA of DKK 39.8 m. Waterlan d Private Equity is a leading European private equity firm, which has made investments in more than 600 companies. In 2020, Waterland was awarded the prize as Pan – European Private Equity House of the Year at the Real Deals Private Equity Awards. VIA equity is a leading northern European multi – stage private equity firm with a successful history of building and transforming companies into leading national and international actors

The Deal

Since Siteimprove was established in 2003 it has been on an international growth journey leading up to a minority share sale to the American Private Equity firm Summit Partners in 2015, where Nordic M&A was exclusive financial advisors to Siteimprove. Today, Siteimprove has 550 employees in 15 countries and over 7,200 customers globally reaching recurring revenues of above USD 81.6 million (2019 figures). Siteimprove has significant long – term growth potential, driven by increasing market penetration, expansion in key customer segments, and opportunity – generating past investments in product development and platform solutions. Nordic Capital will support Siteimprove’s further development and international expansion by investing in the organi sation and product offering, accelerating its growth as a strong and sustainable company. Morten Ebbesen will continue as significant minority shareholder in the Company and remain as CEO. Growth equity investor Summit Partners, the company’s current min ority shareholder, will divest its holding upon completion of the transaction.

The Deal

Malmos (DK) is a leading landscaping company on the Danish market with c 100 employees and an annual revenue of more than 200 DKKm. With this transaction, Malmos becomes part of the largest European provider of ground maintenance services and landscape construction projects, idverde (FR). idverde has an annual turnover of 5,200 DKKm and 7,000 employees operating throughout France, the UK and the Netherlands.

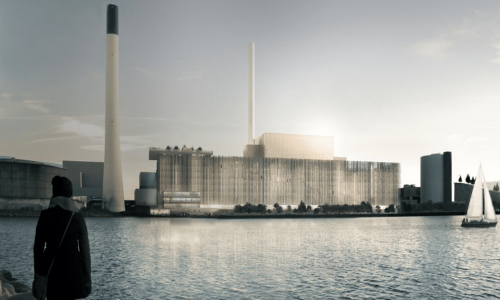

Insight

The success of Malmos is built on a foundation of more than 60 years of expertise within complex landscaping. Through long – standing relations and references on large – scale landscaping projects in Denmark, Malmos completes more than 350 landscaping proj ects annually for corporate clients and contractors. Previous projects include Amager Bakke (Copenhill), Tivoli Congress Center and Carlsberg Byen. Malmos is owned by the management group, including Per Malmos, son of the founder Paul Malmos, who establis hed the company in 1953. The partnership with idverde will strengthen Malmos’ position significantly, with added capabilities and specialised knowledge driven by similar values and a passion for landscaping. idverde is owned by leading European private eq uity company Core Equity Holdings (BE). The current owners of Malmos will remain shareholders by investing in the idverde Group alongside other managers of the Group.

The Deal

MOE is the largest independent engineering consultancy in Denmark, with around 1,000 employees. By entering into partnership with Artelia, MOE becomes part of a strong global player within engineering consulting services. The combined group has more than 6,000 employees.

Insight

MOE is a leading Danish engineering consulting company offering full – service solutions to, primarily, the Building, Energy & Industry and Infrastructure market segments. MOE has a strong Nordic platform with offices in D enmark and Norway, together with a highly efficient production unit in the Philippines. MOE is owned by the employees and the management group. MOE initiated a process to investigate the opportunity to partner with a strong global player with an optimal s trategic and cultural fit and wide – ranging global experience within the specific MOE expertise areas. The world’s leading engineering companies showed great interest, and MOE finally selected a partner that was able to offer continued ownership by MOE ́ s e mployees and management. MOE has joined forces with a company that is similar in manyways: A solid growth – oriented employee – owned business that dates more than 60 years back, with operations in more than 30 countries. The competitive edge for both MOE and Artelia is the continuous focus on maintaining and developing leading engineering consulting capabilities based on a solid foundation of industry – high employee satisfaction based on a high entrepreneurial spirit due to the employee ownership.

The Deal

AnaCap, the specialist European financial services private equity firm acquired a majority stake in leading independent Danish private health insurance business. AnaCap is acquiring the majority stake in SundhedsGruppen from the Company’s Founders, who will retain a minority.

Insight

SundhedsGruppen, provides health insurance and claims management services to clients’ employees and has built a market-leading technological infrastructure that also white labels to other providers in adjunct insurance areas. The Company has a unique partnership arrangement with medical clinics throughout Denmark that allows for best-in-class provision of healthcare services to its customers’ employees, with a clear focus on specialist support and local availability. SundhedsGruppen’s proprietary technological platform facilitates accurate identification of optimal healthcare access as well as reporting, feedback and claims management respectively. AnaCap will now look to leverage its deep insurance sector understanding and expertise in improving both technological and digital infrastructure to support enhancements in the customer experience as well as drive growth in new and existing markets. The business currently provides insurance cover for approximately 250,000 individuals in Denmark, through a client list comprising several of the Nordics’ largest blue-chip companies, having grown from a founder-backed start-up in 2012. Driven by unique market positioning, the Company generated a c.70% CAGR in premiums during the period 2012-2018 vs. a 5% market norm. AnaCap will also deploy its expertise in the insurance sector to support management’s ambition to grow market share internationally, into the Nordics and wider geographical markets, as well as through additional insurance market channels. The growth of the business will be through organic expansion models as well as identifying attractive bolt-on acquisition opportunities.

The Deal

Nordic M&A was the exclusive financial advisor to Interflora Danmark on the sale to Groupe MyFlower (FR) backed by LFPI Group (FR).

Insight

In recent years, Interflora Danmark has evolved the business into a leading Danish occasion-based digital marketplace with unchallengeable brand power, market awareness and revenue growth. In the spring of 2018, Interflora Danmark initiated a process to sell a majority part of its shares fully owned by florists from the Danish Interflora network. Interflora Danmark decided to enter into a partnership with Groupe Myflower, and the change of ownership was approved unanimously by the Danish Interflora florists. CEO Søren Flemming Larsen and his team will continue to develop the Interflora brand in Denmark and Iceland, while contributing and benefiting from synergies of the new group. Groupe MyFlower already operates the Interflora brand in Spain, Portugal and Luxembourg, and the group is playing a significant role in the consolidation of the Interflora brand in a very competitive market.

The Deal

Nordic M&A was the exclusive financial advisor to Helgstrand Dressage A/S (Helgstrand) on the sale to Waterland Private Equity (Waterland). The aim of the sale was to accelerate Helgstrand’s global growth strategy.

Insight

Helgstrand is one of the world’s leading equestrian sports companies with state-of-the-art sales and training centres in Aalborg, Denmark, and Wellington, US. The business sources, develops and sells first-class dressage horses, and Helgstrand has won several World Championships over the years. Danish top equestrian and Olympic medal winner Andreas Helgstrand, who continues as a minority shareholder and remains the CEO of Helgstrand Dressage, founded the business in 2008. He has created a highly successful international business with sales activities in more than 35 countries and more than 70 employees. The majority of Helgstrand’s revenue is generated in Europe today, and the com-pany’s strong global position and brand will be leveraged to expand into other attractive markets in the coming years. With the deal, Waterland became the majority shareholder in Helgstrand and, thereby, completed its first investment in Denmark after the opening of Waterland’s office in Copenhagen in August 2017. Waterland is an independent private equity investment group that supports entrepreneurs in realising their growth ambitions. Waterland pursues a focused buy and build strategy. With substantial financial resources and committed industry expertise Water-land will support Helgstrand in the expansion of the business with the ambition of creating the world’s leading equestrian sports company.

The Deal

Nordic M&A was the exclusive financial advisor to M. Larsen on the sale to Remondis. With the Remondis-partnership, M. Larsen became part of one of the strongest global players within transport, water management, waste and recycling services to the industrial market.

Insight

M. Larsen was founded in 1947 as a family-owned business in the field of waste recycling. The company has grown into one of Denmark’s largest players with almost 450 vehicles and more than 800 employees. M. Larsen was looking for a strong partner with wide-ranging international experience in the field of waste management and recycling in order to strengthen the future strategic development of the business. M. Larsen sold a majority stake to Remondis and, thereby, joined a company that is similar in many ways: A solid and experienced family- owned business that dates 80 years back. However, Remondis operates on a much larger scale at more stages of the value chain, but still within the fields of waste and recycling while focusing on resource efficiency and sustainability. By entering into a visionary partnership with Remondis, M. Larsen got access to know-how within new areas and financial strength to continue the impressive growth.

The Deal

Nordic M&A was the exclusive financial advisor to Sjølund A/S on the sale to the German private equity fund, Deutsche Beteiligungs AG (DBAG). The owner and CEO of Sjølund, Søren Ravn, sold 51 per cent of his shares to Deutsche Beteiligungs AG. With this injection of capital and expertise, Sjølund will reach further out to global markets.

Insight

Sjølund is a leading manufacturer of aluminium and steel components. The company operates in the niche market for complex components made of bent aluminium and steel supplying its products to the wind power industry, the high-speed train industry and construction. Sjølund was established in 1936, and with 80 years of experience the business has built stable customer relationships and a strong market position while reaching a size of around 130 employees. Headquarters are situated in Sjølund, Denmark. Sjølund strives to expand internationally and, consequently, was looking for a partner who could provide additional know-how and execution power for continued global development. Sjølund has operations in several growth markets and will continue its journey to exploit the opportunities within the key business segments including the fast growing high-speed train segment.

The Deal

Nordic M&A was the exclusive financial advisor to Friluftsland on the sale to the international group Fenix Outdoor, which is listed on the Stockholm Stock Exchange. Formally, Friluftsland joined the subsidiary company Frilufts Retail Europe AB. With the deal, Fenix Outdoor entered a new market while Friluftsland is now backed by a strong global player.

Insight

Friluftsland sells apparel and equipment for an active outdoor life. Focus is on high-quality products and services ensuring that customers always meet highly skilled staff. Friluftsland believes that great equipment is the way to better adventures. The first shop opened in June 1980 in a small cellar with short opening hours in Copenhagen. The shop soon became a success, and in 2017 Friluftsland operated nine concept stores and a web shop and was the highest earning chain of outdoor shops in Denmark. A few years back, Friluftsland tried to enter the Swedish market, but Fenix Outdoor proved to be a tough competitor. In many ways, Fenix Outdoor resembles Friluftsland given that it focuses on the development, production and sale of high-quality equipment and apparel for outdoor activities. However, Fenix Outdoor operates in a much larger scale, and due to the sale Friluftsland will have the opportunity to develop the Danish business even further.

The Deal

Nordic M&A was the exclusive financial advisor to Infare Solutions (Infare) on the acquisition of QL2 Software’s (QL2) air data business backed by Ventiga Capital Partners (Ventiga). The acquisition of QL2 supported Infare’s goal to enhance its offer in airfare data and analysis tools focused entirely on serving the needs of airlines and airports.

Insight

The airfare intelligence specialist Infare was founded in 2000 in Copenhagen, and today more than 165 airlines and airports rely on Infare to deliver high- quality, consistent airfare data and analysis tools that enable day-to-day and long-term strategic revenue management. Infare employs 80 specialists and delivers more than 2.5 billion airfare observations to its customers worldwide every day through customised data files. The acquisition was fully in line with Infare’s strategy of delivering the most comprehensive data and competitive intelligence tools for the global airline industry. Ventiga – a leading London-based private equity fund – is now a shareholder in Infare and backs Infare and its management team in its growth strategy. Ventiga funded the QL2 deal through an investment in Infare. As a result of the transaction, Infare took over QL2’s current airline and airport customers consolidating the position as the clear global.

The Deal

Nordic M&A was the exclusive financial advisor to Gjensidige on the acquisition of Mølholm Forsikring from PFA Pension. With this acquisition, Gjensidige became the leading provider of health insurance in a market that is growing year by year.

Insight

Gjensidige is a leading Nordic general insurance group operating in Denmark, Norway, Sweden and the Baltic States. The company has around 4,000 employees and its head office situated in Oslo, Norway. The vision of Gjensidige is to safeguard life, health and assets for customers in the private and commercial markets by offering financial services on competitive terms. Gjensidige is also working systematically to become the most customer-oriented company in the Nordic general insurance field, and customer satisfaction was, in fact, record-high in 2017 and previous years. Mølholm is Denmark’s largest and most specialised provider of health insurance to both business and private customers. Following the acquisition, Mølholm and their 75 employees became part of Gjensidige Nordic, which is managed from Denmark. The acquisition of Mølholm Forsikring was part of Gjensidige’s strategy focusing on growth in the health sector, among others. The acquisition cemented Gjensidige’s new position as a leading provider of health insurance on the Danish market.

The Deal

Nordic M&A acted as financial advisor to Alectia on the merger with Niras. The merger created a new major player in the consulting engineering industry.

Insight

Alectia was a Danish consulting engineering firm with around 700 employees that dates back to 1912. Through the years, Alectia had developed from a pure engineering company to a consulting company with competences in multiple fields such as construction, medical, water supply and work environment. Niras is Denmark’s third largest consulting engineering firm with 1,400 employees. With the merger of Alectia and Niras the industry witnessed a merger between two of its largest companies in Denmark. The merged company continues under the name Niras, and with more than 2,000 employees globally, the merger allows the new company to offer the customers a broader field of expertise. The aim of the merger was to create a more competitive company and a solid platform for future growth. Both companies had aggressive growth strategies, and the greater financial power obtained through the merger will allow the companies to fulfil their growth strategies aiming at becoming a true Nordic company with a global orientation.

The Deal

Nordic M&A was the exclusive financial advisor to Siteimprove on the investment from Summit Partners. The investment supported Siteimprove’s continued expansion of its global operations, sales and marketing as well as the development of its software distribution solutions for web governance (SaaS / cloud).

Insight

Siteimprove A/S was founded in Copenhagen in 2003 and is a leading provider of web governance software. Siteimprove’s headquarters are situated in Copenhagen and Minneapolis, and the company has 500 employees across eleven global offices. More than 3,500 customers rely on Siteimprove to enhance their web and mobile sites and ensure adherence with external regulations and internal content policies. Siteimprove is the global leader in SaaS-based web governance solutions, and its SaaS platform enables marketers and web professionals to manage and optimise their web presence through automated quality assurance, accessibility compliance and analytics. In 2015 Siteimprove had experienced twelve years of strong organic growth, profitability and global expansion, and therefore the company was looking for an experienced global partner who could support Siteimprove as it continued to scale internationally. Summit Partners is a leading global growth equity firm established in 1984 with a commitment to partner with exceptional entrepreneurs to help them accelerate their growth and achieve dramatic results. The investment has made it possible for Siteimprove to accelerate growth and capitalise on opportunities in the broader web governance market.